Asset Allocation

Is There A Secret To Higher Returns using Asset Allocation?

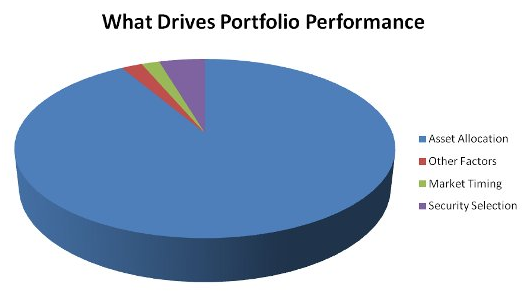

Most people think that making money in the stock market is about buying low and selling high all the time at the right time. That is called market timing. These people might also think that they can predict the bottom of the market and the top of the market. Numerous studies and research has been published that makes the valid argument that one’s portfolio performance is primarily a factor of one’s asset allocation. Market timing and security selection only make up a minor part of portfolio returns.

Over 90% of your returns are because of your asset allocation, 5% is from security selection, and only about 2% from market timing.

Asset allocation consists of different asset classes such as… large cap equities, mid cap equities, corporate bonds, government bonds, international equities, real estate, etc. Over 90% of your returns are going to be based on how you allocate to these different options.

There are usually hundreds of options to choose from when it comes to security selection. An example of security selection inside of large cap equities would be your choice of XYZ Mutual Fund or ABC exchange traded fund. Rest easy because your selection between the two will only account for about 5% of your overall returns.

There are usually hundreds of options to choose from when it comes to security selection. An example of security selection inside of large cap equities would be your choice of XYZ Mutual Fund or ABC exchange traded fund. Rest easy because your selection between the two will only account for about 5% of your overall returns.

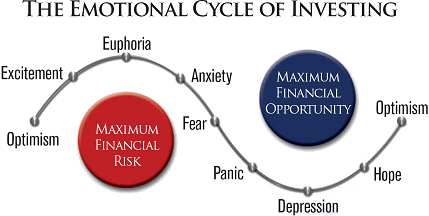

Lastly, trying to figure out the bottom or the top of the market is impossible and hindsight is always 20-20. Fortunately it only accounts for about 2% of our portfolio returns. Market timing is where most people get into trouble. The trouble comes about because people are so emotionally tied with their money that they make careless investing errors, such as selling off all investments after your portfolio decreases by 30% and then waiting to get back in the market after it has already made a full recovery. Does that sound like you or someone you know? If it sounds like you or someone you know, seek competent advice so you don’t fall prey anymore to the behavior gap.

The behavior gap is the difference between the rate of return that a well balance portfolio earns and the rate of return that your average investor earns by moving their money around in an emotional response to the news they get about the markets. This behavior gap ranges between 4-5% per year!

Do you want to earn a higher rate of return than your friends?

Then bridge that gap, work with a qualified financial advisor.